Early Friday morning, February 9th, Congress passed a balanced budget, which President Trump signed into law later in the day. The new law turned the page on the scope of state Medicaid agency third party liability rights. Prior to Friday morning, and following the 2013 Budget Act, states were to change their laws to increase their share of recovery to include any part of a settlement, judgment, or other payment, and not just the part associated with past medicals. Today, states are once again limited to that part of the settlement that represents past medical expenses paid by state Medicaid agencies

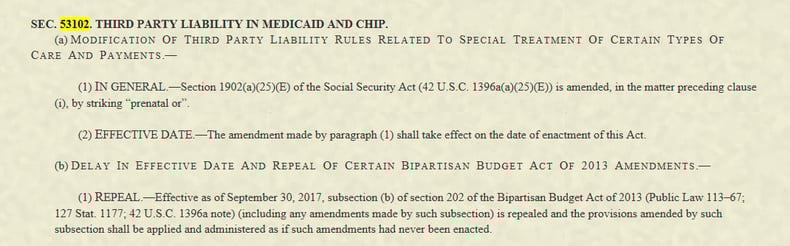

In a rather technical piece of legislation, Section 53102 of The Bipartisan Budget Act of 2018 (the “2018 Budget Act”), includes a major change to state Medicaid third party liability recovery rules.[1] Prior to this change federal law required states to legislate increases to Medicaid’s scope of recovery by extending Medicaid liens to any part of a settlement, judgment, or other payment--not just the part associated with past medicals. The 2018 Budget Act, through repealing the scope of state Medicaid lien expansion, effectively limits Medicaid recovery to that part of the settlement that represents past medical expenses paid by state Medicaid agencies.

So what does this mean? Absent this legislation, Medicaid agencies had the right to assert medical liens against Medicaid beneficiaries’ entire recovery — not just the part relating to past medical expenses. With this change, third-party settlement funds intended to compensate for non-medical damages, such as pain and suffering, lost wages, or any other damages other than medical expenses are not going to be subject to the reach of state Medicaid agencies seeking recovery. Accordingly, attorneys addressing these issues are advised to take the same approach as pre-2013: familiarize themselves with state Medicaid lien laws, Ahlborn and its progeny early on in their process and take steps to educate themselves and their clients on how best to protect their Medicaid health insurance coverage.

The best way to address a Medicaid lien is to understand your case, and as appropriate, be able to prove up each category of damages using a “black-boarded damages” analysis[2]. For example, if you know that your policy limits case has five damage types and your case file includes evidence supporting an allocation to each type, the categories that do not relate to past medical expenses should remain free from the Medicaid lien because the Ahlborn decision that disallowed liens against a Medicaid beneficiary’s “property” until that beneficiary dies is once more the law of the land.

The Ahlborn decision interjected fundamental fairness into states recovery rights. States have a third party assignee’s recovery right for the medical expenses paid on behalf of a Medicaid beneficiary, which is why they have the right to recover for that part of the blackboard. States do not, however, have a right to recover against the parts of a settlement representing pain and suffering, lost wages, and other economic, non-medical damages. For example, it would be unfair for a state to recover $80,000 out of a $90,000 settlement even where that state paid $80,000 in medical bills for the Medicaid beneficiary. Instead, in that same example, if only $9,000 was identified as allocable for past medicals, that is the part of the bucket against which state Medicaid agencies and their contractors could recover. Although the 2013 Budget Act did not expressly state as much, its expansion of those states’ rights would have put the medical lien ahead of all other damages.

The Garretson Resolution Group will continue to monitor the changes in the Medicaid compliance world, and will keep you updated on all relevant developments. If you need more information, please contact Sylvius von Saucken, svs@garretsongroup.com or call us at (704) 559-4300.

[1] In Arkansas Dep’t of Health & Human Servs. v. Ahlborn (2006), the Supreme Court, in a rather unprecedented 9-0 decision, held that the State’s third party liability provisions allowing for Medicaid to recover against the entire settlement was pre-empted by the Federal Medicaid Anti-Lien provision (Section 1917 of the Social Security Act). As a result of this decision, the general rule developed by Ahlborn and its progeny of cases is that the States cannot place a lien on a Medicaid beneficiary’s third party liability settlement during his/her life for more than the amount allocated for medical expenses. For further background, see GRG Client Alert, Medicaid Secondary Payer Provisions Delayed, dated April 8, 2014.

[2] Attorneys can black-board their clients’ cases to identify the full case value (prior to discounting for settlement factors) by gathering case evidence to identify, list, and then value all damages. Once listed, the total amount of a full recovery is compared against the settlement amount, with damage categories, including past medicals, pro-rated against the settlement dollars. The pro-rated amount that relates to past medicals state Medicaid agencies paid becomes the Medicaid lien amount. Best evidence to show full damages would include economic and non-economic damage expert reports and life care plans. Where such reports are not available, other evidence showing the full value of a case before settlement can still be used, including evidence from the attorneys’ file.

Leave a Comment